The Martingale strategy involves a mathematical concept that bets on the probabilities for a mean reversion to occur in the market as the price, according to this concept, can not go in a single direction all the time.

The primary goal of this strategy is to encourage traders to double the position size on that mean reversion to recover from a previous loss. For example, if a trader’s risk is 1% per trade and loses in the first attempt, the trader will then risk 2% in the next attempt. This way, the trader will recover from a loss rapidly.

Although this strategy promises a recovery, it involves taking a higher risk. This risk assumption can be really detrimental to proper capital management.

Principles: Does it Work in Crypto Trading?

In the crypto markets, where irrationality influences most price movements through volatile seasons, the Martingale can be a double-edged sword.

It can actually be an excellent method to recover quickly from losses, but the same conditions that represent a benefit also play a detrimental role.

In an environment like the crypto markets, where assets’ prices experience sharp movements through massive liquidation sweeps along other market effects like manipulation, trying to guess where the price should reverse or assuming that it can not continue longer in a single direction may not be the best approach.

Source: Martingale Trading Strategy: Principles of Martingale!

The Martingale’s Principles For Risk Management

Here, it is necessary to remark on the principles of the Martingale strategy:

- Double up on losses to recover fast.

- Reduce position sizes on winnings to preserve gains.

- The price has to reverse at some point.

How can this work for risk management? One notable principle (and also counterintuitive) is to reduce the position size on winning streaks.

That proposal goes against trend-trading strategies that require sticking to a trend and suggests adding more to a position as the more profitable way to approach the market.

On the other hand, averaging losses is a potential receipt to blow an account.

Check out also: Martingale Trading Strategy: Implementation In Trading!

When And How Is Martingale Useful?

Beyond all the pitfalls noted above, we can say the Martingale Strategy can still have some utility if traders implement it wisely.

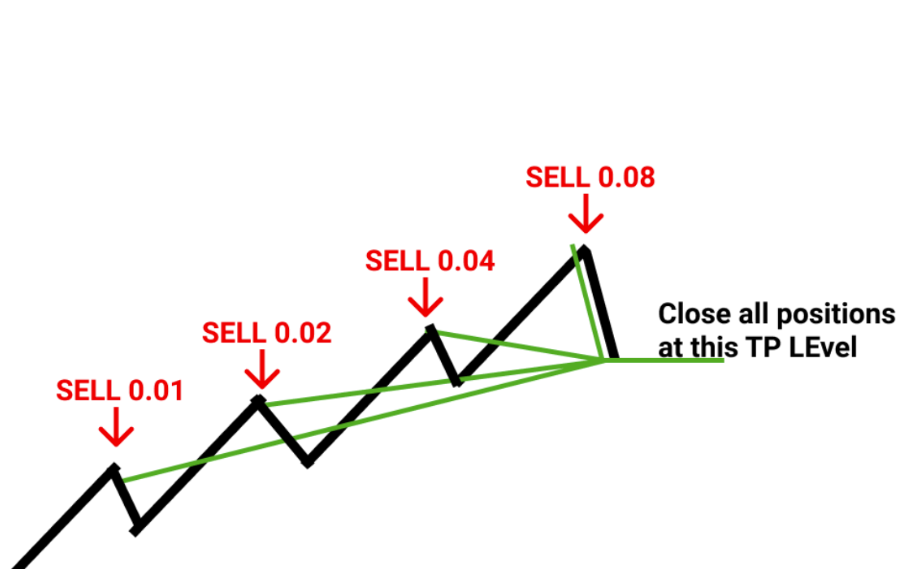

Let’s look at an exciting scenario where the martingale concept can come in handy: unrealized equity during winning trades. It would work such as follows:

- During a winning position, it is typical for the price to retrace as this advances toward take-profit targets.

- By trailing the stop-loss order, traders should protect their position by placing it at break-even or, if possible, above the entry point, ensuring at least a small profit.

- If the price retraces more than expected but still remains above the entry point and around a healthy zone, traders can double up their position on a further entry if they are confident.

- In this case, the trailed stop will protect against a bigger loss in case the second trade fails.

Releated: Crypto Investors’ Secret Weapon

Conclusion

The Martingale Strategy is more a betting system than a trading strategy. However, its concept carries intriguing ideas that traders can implement through a custom approach. For crypto markets, it implies higher risks.

Find this strategy intriguing? Dive deeper into the world of trading strategies by exploring more posts on Buzz Revolve!