Choosing the right Medicare Advantage plan can feel overwhelming, especially when there are so many options available. Whether you’re a first-time enrollee or looking to switch plans, understanding how to compare plans and avoid common pitfalls is crucial. This blog will guide you through the process, making it easier to choose the best plan for your healthcare needs.

1. Understand What Medicare Advantage Plans Cover

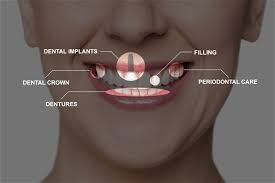

Medicare Advantage, also known as Part C, combines Medicare Parts A (hospital insurance) and B (medical insurance). Most plans also include Part D (prescription drug coverage). While the coverage is similar across all plans, benefits can vary depending on the provider. Some plans may offer additional benefits like vision, hearing, dental, and wellness programs.

It’s essential to compare what each plan offers in terms of these added benefits, ensuring they align with your personal health needs. Failing to consider this could leave you missing out on essential services or paying extra for benefits you don’t need.

2. Compare Costs Beyond Premiums

Many people focus solely on the monthly premium when comparing plans, but there are other costs to consider. Medicare Advantage plans may have co-pays, deductibles, and out-of-pocket maximums that can impact your total annual costs. Make sure to examine all these elements to get a full picture of what you’ll be paying.

It’s also important to check whether your preferred doctors and hospitals are in-network, as out-of-network care can lead to higher costs. This is a common pitfall that can quickly increase your healthcare expenses.

3. Examine Prescription Drug Coverage

Not all Medicare Advantage plans include prescription drug coverage, and those that do may have different formularies (lists of covered drugs). If you’re currently taking medications, it’s crucial to compare the plans’ formularies to ensure your prescriptions are covered. Some plans might have restrictions such as prior authorization or step therapy, which could complicate your access to medications.

By overlooking these details, you may end up paying more for prescriptions or struggling to get the medications you need.

4. Check the Plan’s Star Rating

The Centers for Medicare and Medicaid Services (CMS) rates Medicare Advantage plans on a scale of 1 to 5 stars. These ratings reflect the quality of care and customer service provided by the plan. A higher star rating generally indicates better performance. When comparing plans, use this star rating as a helpful tool to ensure you’re choosing a reputable option.

A common mistake is ignoring these ratings, which can leave you with a plan that offers poor customer service or substandard care.

5. Be Aware of Plan Restrictions

Different Medicare Advantage plans come with various restrictions. Health Maintenance Organization (HMO) plans, for example, require you to use in-network doctors, while Preferred Provider Organization (PPO) plans offer more flexibility. However, PPO plans may come with higher costs for out-of-network care.

When comparing plans, think about how much flexibility you need. If you travel often or want the freedom to choose specialists, you might want to avoid plans with restrictive networks. Failing to do so could lead to unexpected costs or limited access to the care you need.

6. Consider the Timing

Every year, Medicare Advantage plans can change their coverage, costs, and networks. Open Enrollment, which runs from October 15 to December 7, is the time to review and compare plans for the upcoming year. If you don’t review your plan annually, you could be stuck with a plan that no longer meets your needs or costs more than expected.

Make sure you compare your current plan to the new options available to avoid missing out on better coverage or cost savings.

7. Seek Personalized Advice

While online tools and plan comparison websites can help you compare Medicare Advantage plans, sometimes it’s best to speak with an expert. Licensed Medicare agents can provide personalized advice based on your specific healthcare needs and budget.

Additionally, the Medicare Advantage Plans in Florida 2025 are expected to offer various options tailored to the needs of seniors in the state. Comparing these plans with the help of a professional can help you avoid costly mistakes and ensure you make the best choice.

Conclusion

By understanding coverage details, comparing costs, checking drug coverage, and reviewing plan ratings, you can confidently choose the right Medicare Advantage plan. Be sure to avoid common pitfalls like ignoring network restrictions or overlooking prescription drug coverage. With the right research and planning, you can find a plan that fits your healthcare needs and budget.