The world of health care insurance can seem overwhelming, regardless if you are an individual or part of a family. It’s difficult to navigate the world of health insurance, whether you’re an individual, a family, or a business. The health insurance broker comes into play. From the moment you begin to consider a health insurance plan until the moment you file a claim, brokers are there as your guide. This article explains how health brokers assist you throughout the year and why their services are vital for anyone looking to maximize his or her benefits.

What Is The Role Of Brokers In Enrolment?

During the enrollment period, having a health broker on your side is important. When you enroll in a health insurance program, your choice will affect your healthcare coverage for the rest of the year. Health insurance agents can be a valuable resource in this phase. They will help you understand all the available plans, compare their costs and features, and make sure the plan you select is right for you.

The role of group health insurance agents is vital for businesses. They help companies understand all the group health options available and can assist with selecting the plan that will benefit both the employees and the business. These agents help ensure the enrollment procedure is as smooth as possible, answering employees’ questions and helping them choose the best plan for their individual needs.

Ongoing Plan Support And Management

The support provided by your broker is not over once you have signed up for health insurance. You can contact your broker at any time to manage your plan. These brokers will answer your questions, explain your benefits, and help you get the most out of your plan.

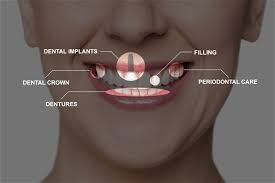

You can ask your broker to help you add dental insurance to your plan or find a suitable policy. The broker can also clarify what the immediate dental insurance will cover, ensuring you fully understand your out-of-pocket costs and any limitations.

Brokers also offer assistance with changes and additions to your dental plan. A health insurance agent can help you if there is a life-changing event like a new baby or marriage. They can also review your current coverage and make any necessary changes.

Claims Assistance And Problem Resolution

It is not uncommon for filing a medical insurance claim to be the most stressful part of dealing with a policy. Making a claim can be time-consuming and difficult if you’ve never done so before. Health insurance agents can help you by explaining the claims process, assisting with paperwork, and advocating for your cause if there are any problems.

This support includes helping employers resolve employee complaints. The agent will intervene if there is a dispute between an employee and their employer. This way, they ensure the employee receives all the benefits to which he or she is entitled. This level of support not only helps individuals but also reflects well on employers.

In addition to helping with claims, health insurance brokers can help resolve any issues that may arise with your insurance provider. The broker acts as your advocate to resolve the problem as quickly as possible, whether it’s an error in billing, a concern about coverage, or a dispute regarding a particular claim.

Renewal Of Plan And Review At Year End

You must review your health coverage as the calendar year concludes and make any necessary modifications. In this process, the role of health insurance brokers is crucial. They can help determine whether or not your current insurance plan meets your requirements and if there is a need to change, renew, or switch plans.

The role of the group health agents in reviewing this plan is crucial for businesses. They gather employee feedback, analyze the performance of the existing plan, and make any necessary changes. This ensures that employers continue to offer valuable and competitive benefits.

Conclusion

Health insurance brokers are available to help you at any time of the year. They will guide you through all the steps in the health insurance procedure. Expert advice is offered from enrollment to claim and assistance with plan management and advocacy on your behalf. As an individual or family, you can benefit from having a broker on your side. With their assistance, you can confidently navigate the complexities of insurance.