Introduction: Understanding Retirement Account Options

The world of retirement accounts is like a jigsaw puzzle of various options, based on your employment status, your income level, and your goals for retirement. It’s very important to know the differences between Traditional IRAs, Roth IRAs, 401(k) plans, and other retirement accounts to assure one makes feasible choices in light of their financial objectives. Be it maximising the tax advantages, securing a future, or facilitating business continuity, each of these retirement accounts has certain special benefits and challenges that must be kept in mind.

ITraditional IRA: Benefits, Tax Implications, and Contribution Limits

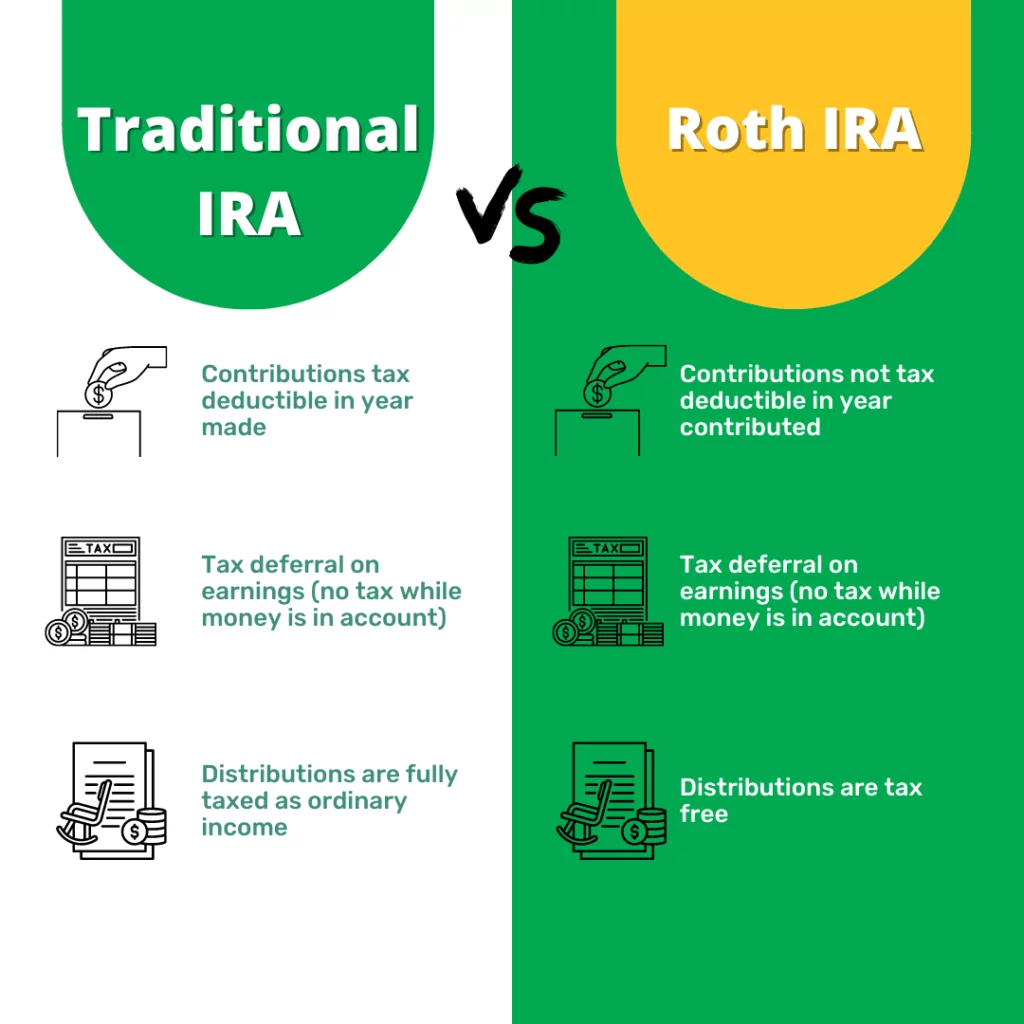

A Traditional Individual Retirement Account, commonly called a Traditional IRA, is one of the most popular retirement savings options. Contributions to a Traditional IRA are generally made with pre-tax dollars, reducing your taxable income by the amount of your contribution for that year. You’ll really see a benefit from this tax deduction if you’re currently in a high tax bracket. Following this, the money grows tax-deferred inside the account, meaning you won’t pay taxes on the gains until you withdraw the money in retirement.

In 2023, the contribution limit for a traditional IRA is $6,500, or $7,500 if you are age 50 or older, which includes a catch-up contribution. The availability of the catch-up provision itself is most important, as it allows those nearing retirement to contribute more toward retirement savings. This type of account is ideal for those who expect to be in a lower tax bracket during retirement compared to where they are currently because, in return, withdrawals taken at retirement will be taxed as ordinary income.

IRoth IRA: How it Differs from Traditional IRA

A Roth IRA, compared to a traditional IRA, has very different tax treatment. Contributions made to a Roth IRA are from after-tax income, and therefore there is no deduction for contributions on your tax return. But the major benefit of a Roth IRA is that qualified withdrawals in retirement are totally tax-free—both principal and investment earnings.

This feature makes Roth IRAs especially attractive to people who think they will be in a higher tax bracket in retirement or who would like to diversify their tax liabilities by having taxable and tax-free sources of income in retirement. Moreover, unlike Traditional IRAs, Roth IRAs do not have required minimum distributions during the owner’s lifetime, so your money keeps on working tax-free for as long as you choose not to withdraw.

I401(k) Plans: Employer-Sponsored Retirement Savings

The 401(k) is an employer-sponsored retirement savings plan that allows employees to save and invest part of one’s paycheck before taking out taxes. One of the enormous benefits associated with a 401(k) is employer matching, which boosts your retirement savings. In 2023, the contribution limit in 401(k) plans is $22,500, with an added catch-up contribution of $7,500 if one is 50 years old and over.

Because a 401(k) allows the funds to grow tax-deferred and defers taxes until withdrawal in retirement, it is convenient for most employees to take care of retirement savings. In particular, if your employer has a very generous matching program, it becomes especially true. However, the 401(k) plans are subject to RMDs beginning at age 73, which means that you will be required to start taking money out of the account and pay taxes on it whether you need the funds or not.

ISEP IRA and SIMPLE IRA: Options for Self-Employed and Small Business Owners

For self-employed and small business owners, there are SEP IRAs—Simplified Employee Pension—and SIMPLE IRAs—Savings Incentive Match Plan for Employees—which allow for specifically designed retirement savings options.

ISEP IRA: This kind of plan has higher contribution limits, up to 25% of one’s compensation or $66,000 for 2023, whichever is less. This plan is quite nice for small business owners who want to make more significant contributions for their own retirement and still provide retirement benefits for employees.

SIMPLE IRA: This type of plan is specifically designed for small businesses with 100 or fewer employees. Employees can contribute up to $15,500 in tax year 2023, and a catch-up contribution of $3,500 may be made by those employees who are 50 years or older. It mandates that each employer match the employee’s contributions up to 3% of compensation or contribute a flat 2% of compensation for all eligible employees, whether or not they contribute to a SIMPLE IRA.

Both SEP IRAs and SIMPLE IRAs have less paperwork and lower administrative costs than traditional 401(k) plans, so they are more attractive to smaller businesses.

IComparing the Tax Advantages of a Traditional IRA vs. a Roth IRA

When determining whether to use a Traditional IRA or a Roth IRA, an individual usually bases his decision on the tax advantages of the two. If you expect to be in a lower tax bracket come retirement, the Traditional IRA might prove more beneficial because you can take the tax deduction now and pay taxes later when your rate is lower. On the other hand, if you believe you are going to be in a higher tax bracket come retirement time, it’s better to have a Roth IRA because you’re paying taxes now at a lower rate, and later, you get tax-free withdrawals.

Essentially, what this comes down to is that a Traditional IRA provides immediate tax relief, and a Roth IRA provides long-term tax savings.

IContribution Limits and Withdrawal Rules Across Retirement Accounts

The planning process should include knowing the contribution limits and the withdrawal rules of the different retirement accounts. Unless you meet an exception, nearly all retirement accounts will impose a 10% penalty on early withdrawals in addition to ordinary income taxes. As one example of a nuance, Roth IRA contributions are always tax-free and penalty-free when withdrawn, but earnings are subject to penalties when withdrawn before age 59½, unless certain conditions are met.

Traditional IRAs and 401(k) plans have required minimum distributions, which begin no later than age 73 and require you to withdraw a portion of your savings each year whether you need the money or not. Failure to take an RMD means looking at big potential penalties, so it’s crucial to know how these rules work in order to avoid some very costly mistakes.

IChoosing the Right Account for Your Financial Goals

You should select the right retirement account based on where you are in your current financial status, tax considerations, and future expectations of income. If you expect to earn considerably more in the future, then contributing to a Roth IRA will make more sense now to enjoy the benefit of lower tax rates. On the other hand, if you are highly paid now, then contributing to a Traditional IRA or 401(k) would be more advisable because you can at least enjoy an immediate tax shelter that will help you save more in the short term.

Like accountants and attorneys, business owners who are concerned with business continuity planning and financial security may also have to consider SEP IRAs or SIMPLE IRAs for themselves and their employees. These not only provide solid retirement savings options but are also a key component of the ability to recruit and retain talent.

IMaximise Your Tax Efficiency with a Certified Tax Planner

It can be very hard to get through the labyrinth of retirement accounts and their respective tax implications without professional guidance. With the help of a certified tax planner, particularly with business tax planning services and individual tax planning services, you can determine your strategy based on how to achieve maximum savings and minimum taxes.

Second, a tax planner can help you design a long-term plan for your goals—retirement savings, estate planning, or business continuation. Business owners and high-income earners in particular can benefit from professional advice, as they usually have more complicated situations in areas such as tax and retirement planning.

IHow SWAT Advisors Can Help You Optimise Your Retirement Strategy

SWAT Advisors are holistic financial planners with individual tax planning, business tax planning services,business continuity planning and individual tax planning services. Their professionals can help you develop a retirement plan that keeps everything in your financial life in order so that you can be more than prepared for the future.

Be it choosing between a Traditional IRA and a Roth IRA, setting up a SEP IRA for your business, or looking into advanced tax strategies that will protect your wealth, SWAT Advisors can help with the expertise in ensuring you optimise your retirement planning.

<H2>IConclusion

Choosing the right retirement account is an important decision that affects your financial security in your golden years. Keeping in mind all the different kinds of accounts and their attendant benefits and limitations, you can make decisions that are likely to keep you in good stead throughout your long-term financial health. Be it a young professional who has just started building the nest egg for retirement or a seasoned business owner somewhere in between, strategic planning with professionals like SWAT Advisors gives you distinct road-mapping toward retirement prosperity and security.